Little Known Questions About Paul B Insurance.

Wiki Article

The Single Strategy To Use For Paul B Insurance

Table of ContentsSome Known Factual Statements About Paul B Insurance The Best Guide To Paul B InsurancePaul B Insurance Things To Know Before You BuyGet This Report about Paul B InsuranceIndicators on Paul B Insurance You Need To KnowThe Basic Principles Of Paul B Insurance

With home insurance, for instance, you can have a substitute expense or actual cash money value policy. You ought to constantly ask how claims are paid as well as what the insurance claims process will certainly be.

:max_bytes(150000):strip_icc()/basics-to-help-you-understand-how-insurance-works-4783595_final-9cf74d5b66d14f88a21ab29ddb290e2d.png)

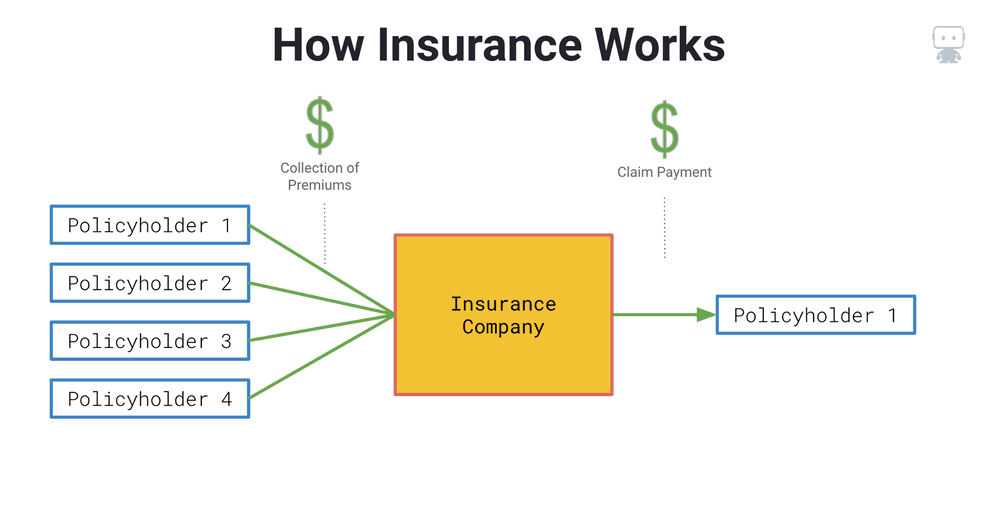

The thought is that the money paid in insurance claims over time will be much less than the total costs gathered. You might really feel like you're tossing money out the home window if you never ever sue, however having item of mind that you're covered on the occasion that you do endure a considerable loss, can be worth its weight in gold.

Some Known Questions About Paul B Insurance.

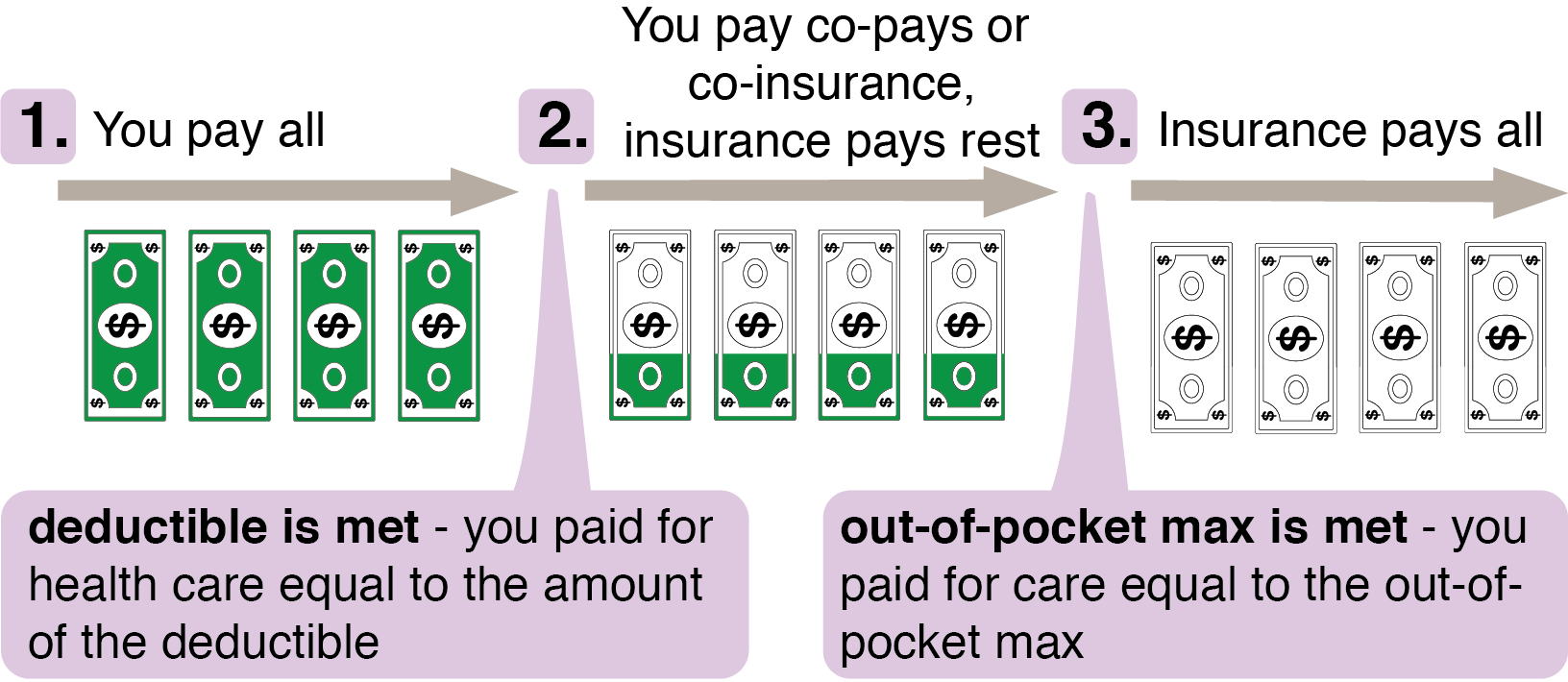

Imagine you pay $500 a year to guarantee your $200,000 house. This suggests you've paid $5,000 for house insurance coverage.Due to the fact that insurance coverage is based on spreading the threat among lots of people, it is the pooled money of all individuals spending for it that enables the company to construct assets and cover insurance claims when they take place. Insurance is a service. It would be great for the companies to simply leave rates at the same level all the time, the truth is that they have to make sufficient money to cover all the possible claims their insurance policy holders may make.

Underwriting modifications and also rate rises or declines are based on outcomes the insurance coverage firm had in previous years. They sell insurance from just one firm.

Some Of Paul B Insurance

The frontline people you deal with when you purchase your insurance policy are the agents as well as brokers that stand for the insurance firm. They an acquainted with that firm's products or offerings, however can not talk towards other companies' policies, pricing, or product offerings.They will certainly have accessibility to more than one firm and have to find out about the series of items offered by all the firms they represent. There are a couple of key concerns you can ask on your own that may aid you decide what sort of insurance coverage you need. Just how much danger or loss of money can you think on your own? Do you have the cash to cover your expenses or debts if you have an accident? What about if your residence or cars and truck is spoiled? Do you have the savings to cover you if you can not function as a result of an accident or disease? Can you manage higher deductibles in order to minimize your costs? Do you Paul B Insurance have unique needs in your life that need added protection? What concerns you most? Policies can be customized to your needs as well as recognize what you are most stressed regarding protecting.

The insurance coverage you require differs based upon where you are at in your life, what type of possessions you have, and what your long-term objectives as well as duties are. That's why it is vital to make the effort to discuss what you desire out of your plan with your representative.

The Greatest Guide To Paul B Insurance

If you get a finance to get a car, and afterwards something occurs to the auto, void insurance will repay any type of section of your finance that conventional auto insurance does not cover. Some loan providers need their borrowers to carry void insurance.The primary function of life insurance policy is to provide money for your recipients when you die. Yet how you pass away can figure out whether the insurance firm pays out the survivor benefit. Depending on the sort of plan you have, life insurance coverage can cover: Natural fatalities. Dying from a cardiac arrest, illness or seniority are examples of natural deaths.

Life insurance policy covers the life of the guaranteed individual. Term life insurance coverage covers you for a period of time selected at acquisition, such as 10, 20 or 30 years.

The Main Principles Of Paul B Insurance

If you do not die throughout that time, nobody obtains paid. Term life is popular due to the fact that it uses huge payouts at a lower cost than irreversible life. It also gives protection for an established number of years. There are some variants of regular term life insurance policy policies. Convertible plans permit you to convert them to irreversible life plans at a higher premium, permitting longer and possibly extra adaptable protection.Irreversible life insurance coverage policies construct money value as browse this site they age. The cash money worth of entire life insurance policy plans grows at a set rate, while the cash money worth within universal plans can change.

If you compare average life insurance policy rates, you can see the distinction. $500,000 of whole life protection for a healthy and balanced 30-year-old lady prices around $4,015 yearly, on standard. That very same level of insurance coverage with a 20-year term life policy would certainly set you back approximately regarding $188 annually, according to Quotacy, a brokerage company.

The Main Principles Of Paul B Insurance

Report this wiki page